# Deposits

# Fixed Term Deposits

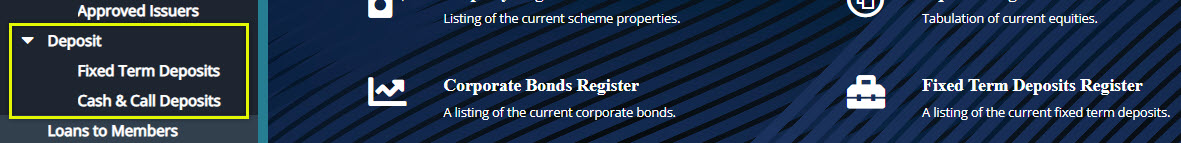

A term deposit is a fixed-term investment that includes the deposit of money into an account at a financial institution. Term deposit investments usually carry short-term maturities ranging from one month to a few years and will have varying levels of required minimum deposits. To view a list of fixed term deposits, the screenshot below:

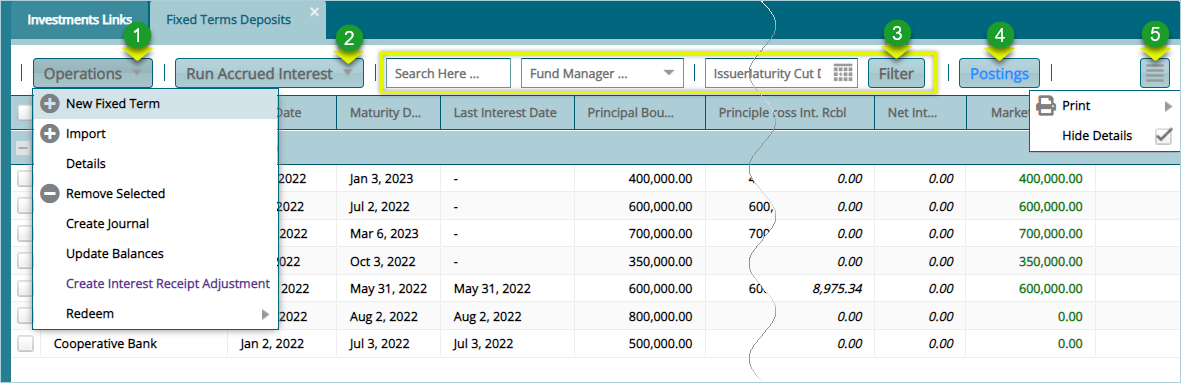

Action

Click Label 1 menu to open a drop-down menu with different activity options such as creating a new fixed term deposit.

Click Label 2 menu to open a drop-down menu to run accrued interest on deposits.

Click Label 3 menu to filter records based on set filter parameters such as fund manager, issuer etc.

Click Label 4 button to post a selected fixed deposit from the grid table.

Click Label 5 button to load a section on the lower section of the window showing all transaction details of a selected fixed deposit record.

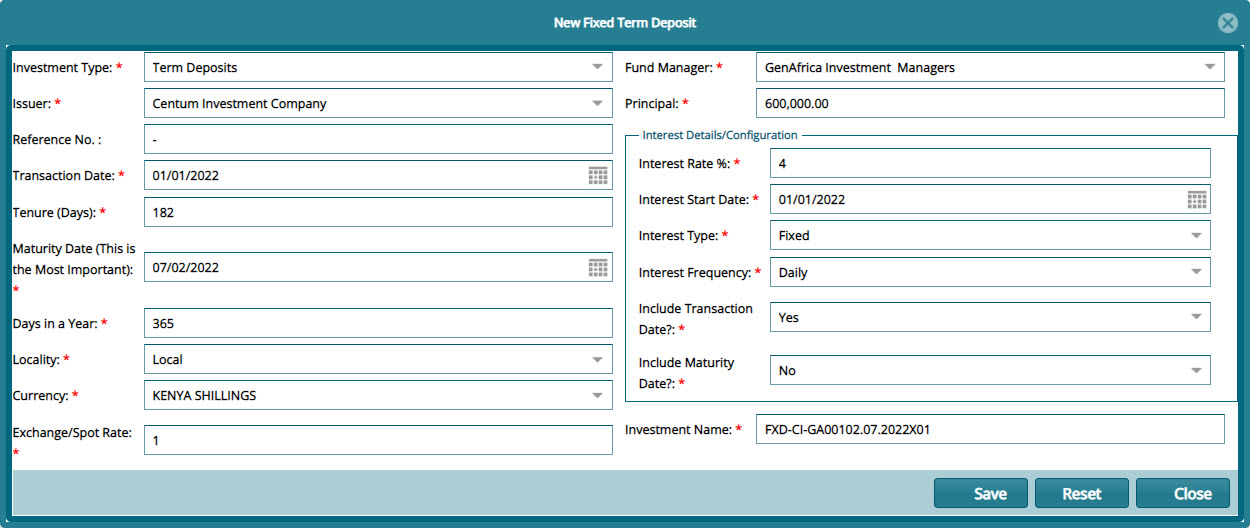

# Creating a New Fixed Term Deposit

Clicking the New Fixed Term will open a dialog box through which a new fixed term can be created as shown below:

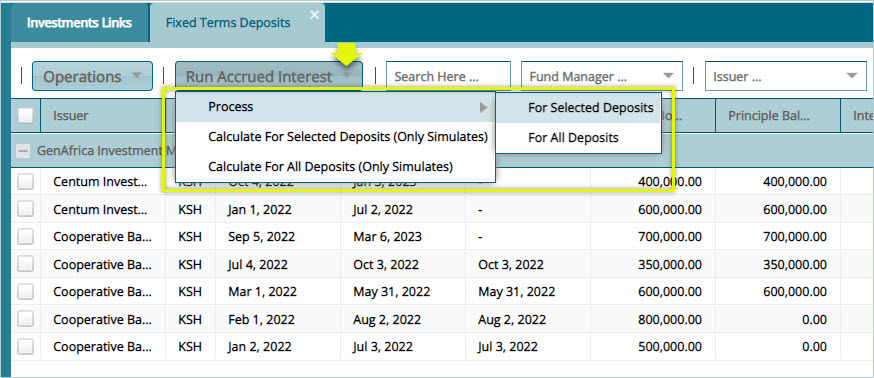

# Run Accrued Interest

To process accrued interest for a fixed term, select the record or run process for all deposits as shown below:

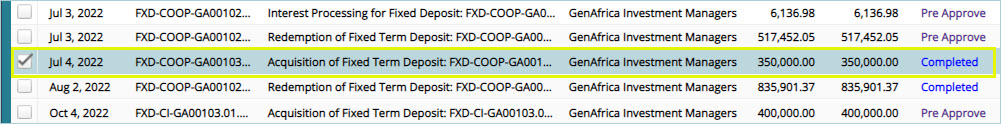

# Posting a Fixed Term Deposit

To post a transaction, select the record from the grid table and take actions as shown below:

Action

Click label 1 button to filter records based on set filter parameters such as fund manager, dates etc.

Click label 2 button to print a schedule.

Click label 3 menu to open a drop-down menu to pre-approve, certify, approve a transaction, or roll back a record action.

Click label 4 button to post a selected fixed deposit from the grid table.

Click label 5 button to process a transaction payment.

Click label 6 button to change a transaction date.

Click label 7 button to load a section on the lower section of the window showing all transaction details of a selected fixed deposit record.

A successful posted fixed term deposit acquisition transaction will look as shown in the screenshot below:

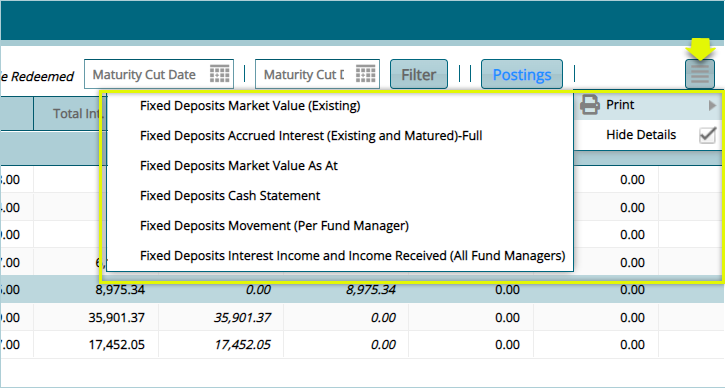

# Printing Various Reports

Click the print menu and from the drop-down click to print various reports as shown below:

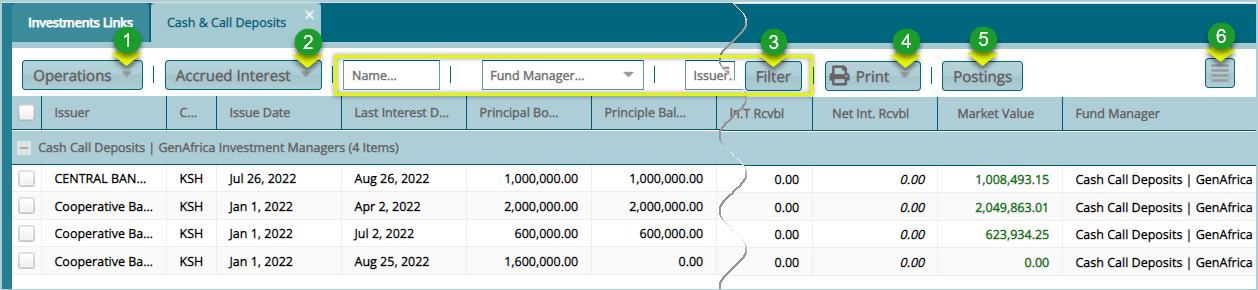

# Cash & Call Deposits

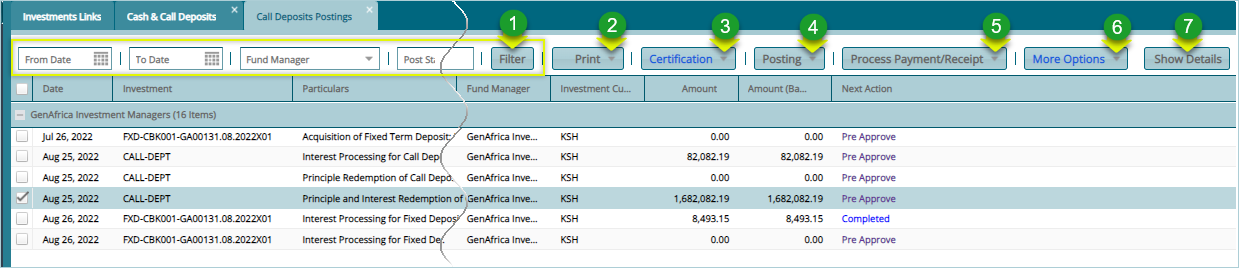

Call deposits are basically accounts that require you to keep a minimum balance in exchange for a higher interest rate. Unlike time deposits, you have ready access to most of your cash, yet are still able to earn a higher return. To view a list of cash & call deposits, the screenshot below:

Action

Click Label 1 menu to open a drop-down list of operation such as creating a new cash and call.

Click label 2 to calculate accrued interest for a selected record among other actions.

Click label 3 button to filter records based on set filter parameters such as fund manager, name etc.

Click Label 4 button to print deposit history among other reports.

Click Label 6 button to post a selected transaction from the grid table.

Click Label 5 button to process a transaction payment.

Click label 6 button to load a section on the lower section of the window showing all transaction details of a selected record.

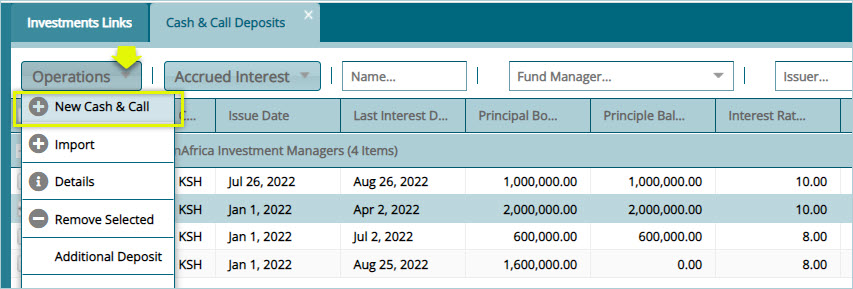

# Creating a New Cash & Call

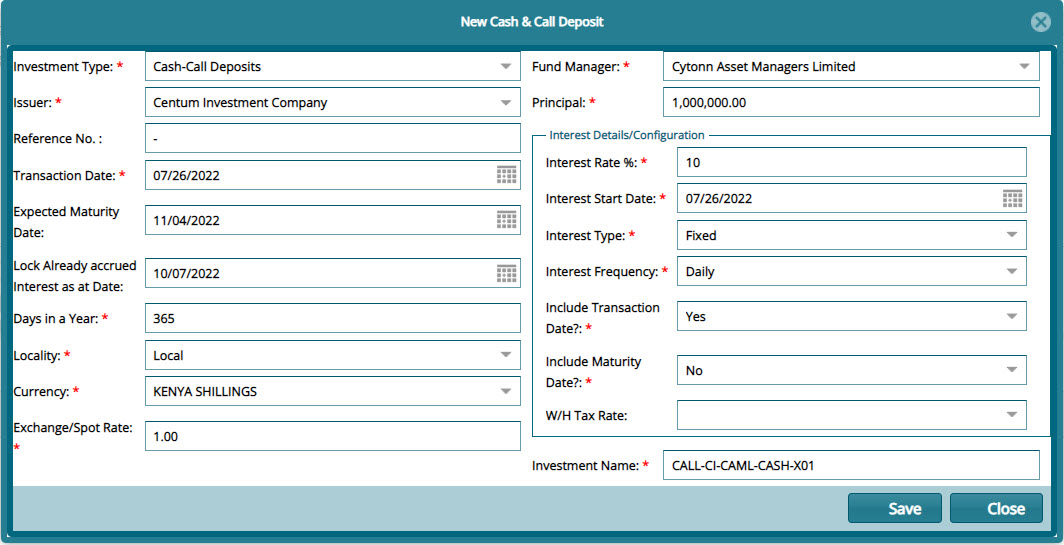

Clicking the New Cash & Call from the Operations menu as shown below:

Clicking the link shown above will open a dialog box through which a new cash & call deposit can be created as shown below:

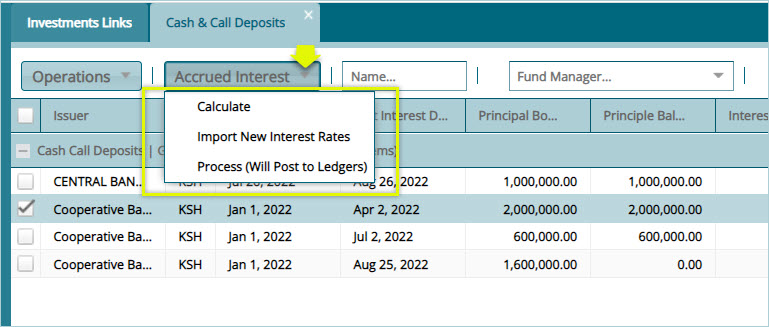

# Run Accrued Interest

To process accrued interest for a cash & call, select the record and click calculate accrued interest among other actions shown below:

Clicking the Calculate link will open a dialog box for defining the date of running the interest and spot rate as shown below:

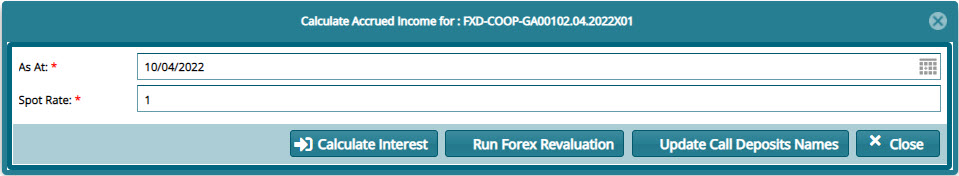

# Posting a Call & Cash deposit

To post a transaction, select the record from the grid table and take actions as shown below:

Action

Click label 1 button to filter records based on set filter parameters such as fund manager, dates etc.

Click label 2 button to print a schedule among other reports.

Click label 3 menu to open a drop-down menu to pre-approve, certify, approve a transaction, or roll back a record action.

Click label 4 button to post a selected call & cash deposit from the grid table.

Click label 5 button to process a transaction payment.

Click label 6 button to change a transaction date.

Click label 7 button to load a section on the lower section of the window showing all transaction details of a selected record.

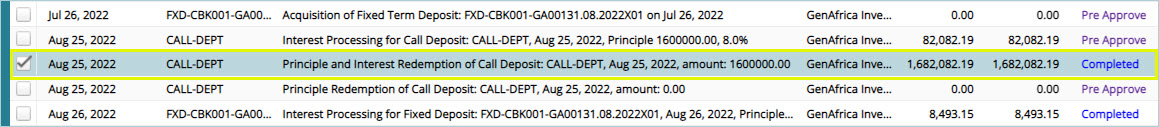

A successful posted transaction will look as shown in the screenshot below:

# Other Investments

# Offshore Investments

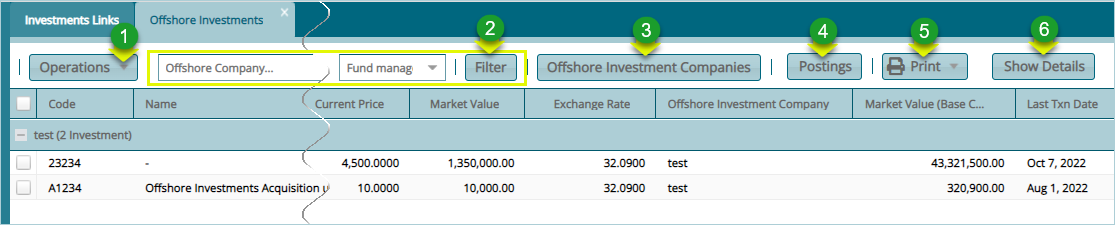

Offshore investments refer to a wide range of investment strategies that capitalize on advantages offered outside of an investor's home country. To view a list of Offshore investments, see the screenshot below:

Action

Click label 1 menu to open a drop-down menu to acquire a new Offshore investment among other actions.

Click label 2 button to filter records based on set filter parameters such as fund manager, Offshore company etc.

Click label 3 button to open view a list of Offshore Investments Companies in a different window.

Click label 4 button to open the postings window and post a selected transaction.

Click label 5 to print an Offshore Investments report such as movements report.

Click label 6 button to load a section on the lower section of the window showing all transaction details of a selected record.