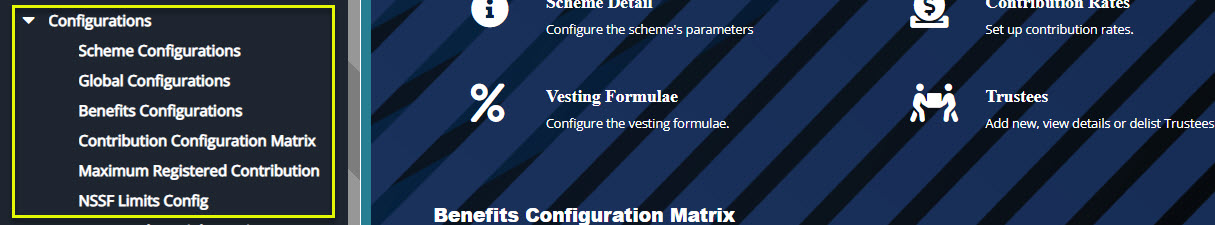

# Configurations

These are some of the key configurations that need to be set for the scheme to execute effectively. Click the drop-down submenu enclosed links to open configuration dialog boxes as shown below:

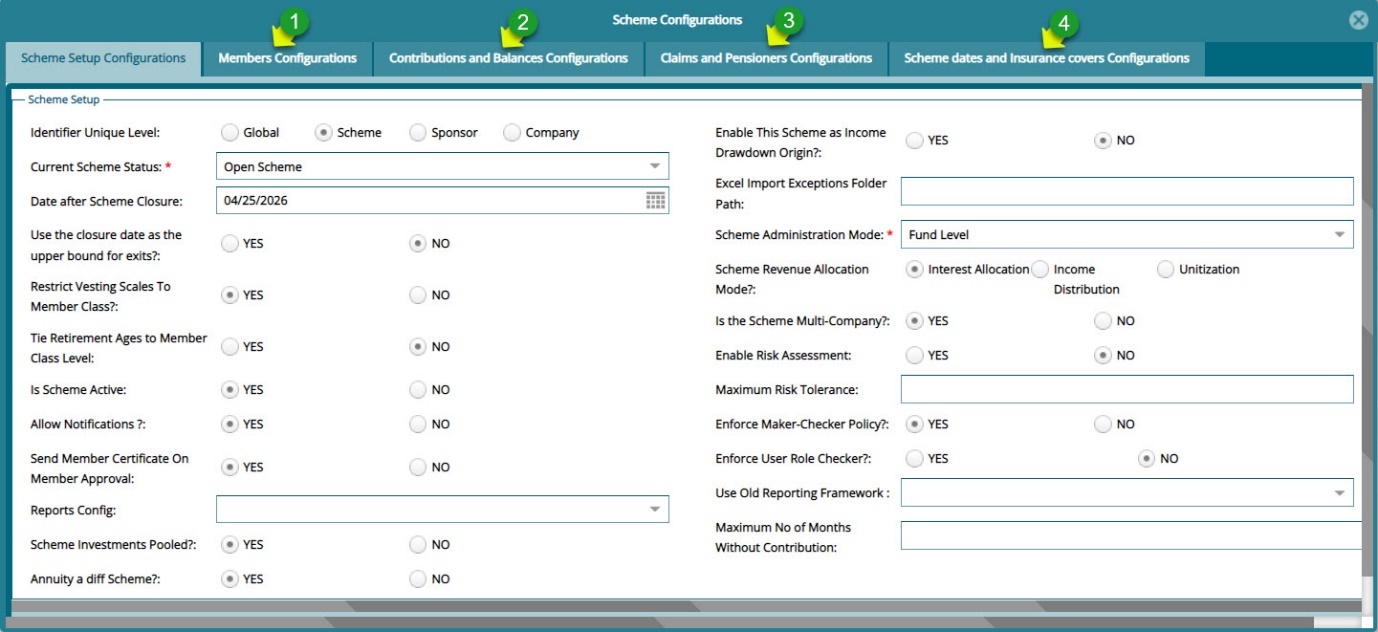

# Scheme Configurations

Click the Scheme Configurations link to open the scheme configurations dialog box and set the required parameters for different sets of configurations such as member configurations as shown below:

Action

Click label 1 tab to load the Members Configurations window for set the appropriate parameters.

Click label 2 tab to load the Contributions and Balances Configurations window for set the appropriate parameters.

Click label 3 tab to load the Claims and Pensioners Configurations window for set the appropriate parameters.

Click label 4 tab to load the Scheme Dates and Insurance Covers Configurations window for set the appropriate parameters.

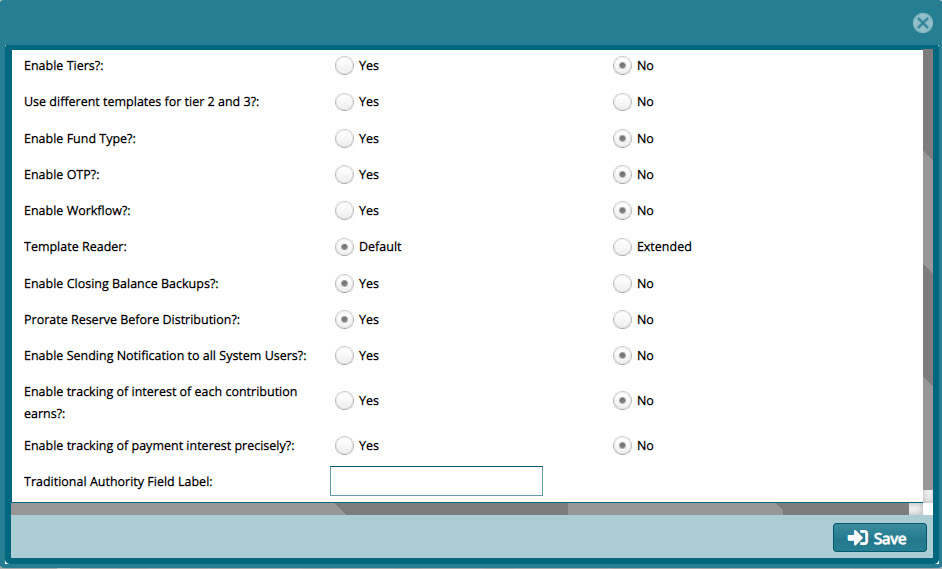

# Global Configurations

Click the Global Configurations link to open a configurations dialog box and set the required parameters as shown below:

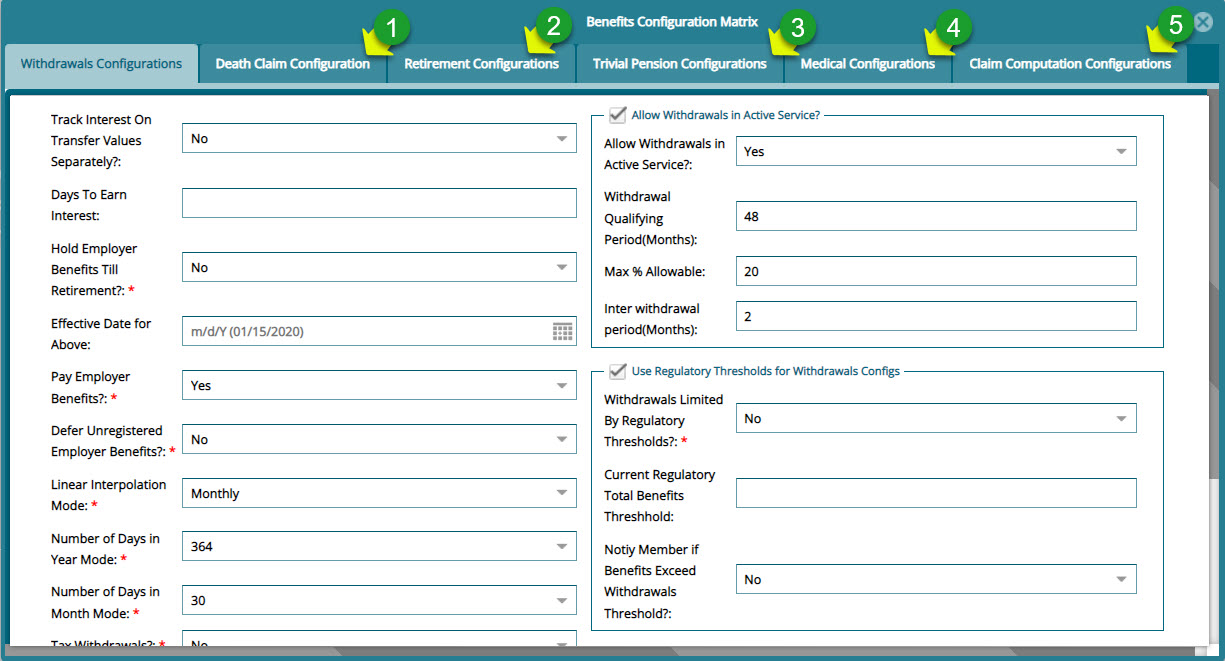

# Benefits Configurations

Click the Benefits Configurations link to open the scheme dates and insurance covers configurations dialog box and set the required parameters as shown below:

Action

Click label 1 tab to load a window for setting Death Claim Configurations parameters.

Click label 2 tab to load a window for setting Retirement Configurations parameters.

Click label 3 tab to load a window for setting Trivial Pension Configurations parameters.

Click label 4 tab to load a window for setting Medical Configurations parameters.

Click label 5 tab to load a window for setting Claims Computation Configurations parameters.

# Contribution Configurations

This matrix addresses issues such as how to treat additional voluntary contributions by a member's employer, severance, and contribution underpayments.

To set parameters for these items, locate the Contribution Configuration Matrix link from the drop-down submenu as shown below:

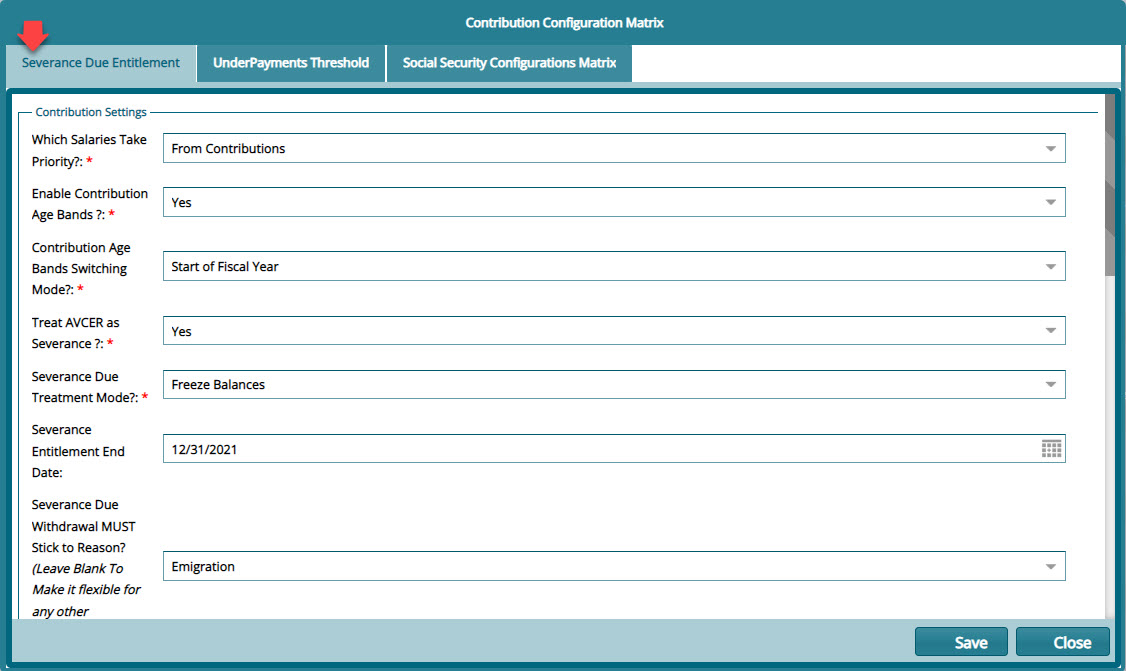

Click this link to open the Contribution Configuration Matrix dialog box where the Severance Due Entitlement parameters are configured as shown below:

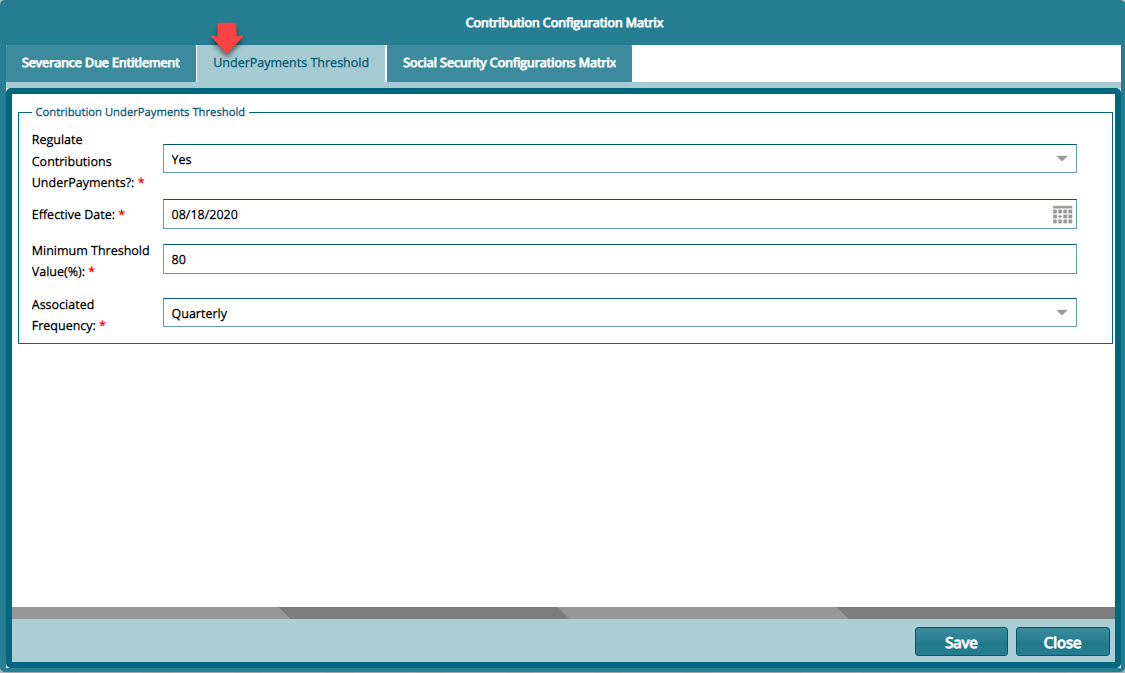

Click the UnderPayments Threshold tab to configure underpayments threshold details as shown below:

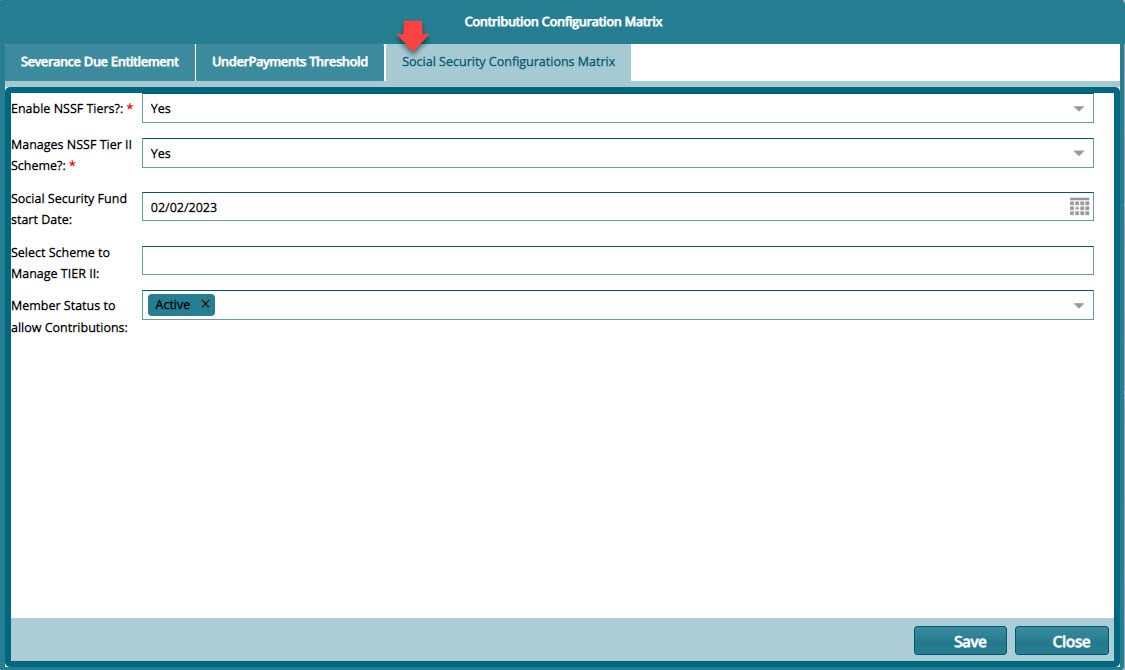

Click the Social Security Configurations Matrix tab to configure the social security contribution details as shown below:

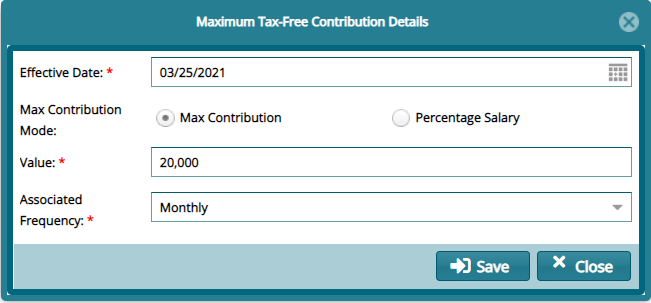

# Max Registered Contribution

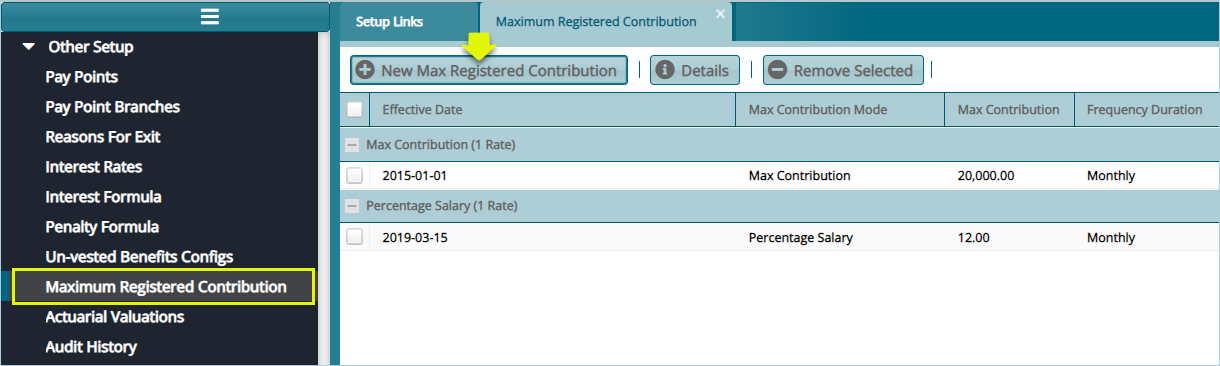

Click the Max Registered Contribution link to open the Maximum Registered Contribution window, then click the New Max Registered Contribution button to create a configuration as shown below:

Tips

This configuration is dependent on the country where the system is used. For instance, in Kenya, the salaried employees registered contribution amount is pegged at a maximum of KES. 20,000.

This means that any contribution above this amount is subjectable to tax. Click the highlighted link to access the window through which a new configuration can be done.

Click the New Max Registered Contribution button to load a dialog box through which a new configuration is set as shown below:

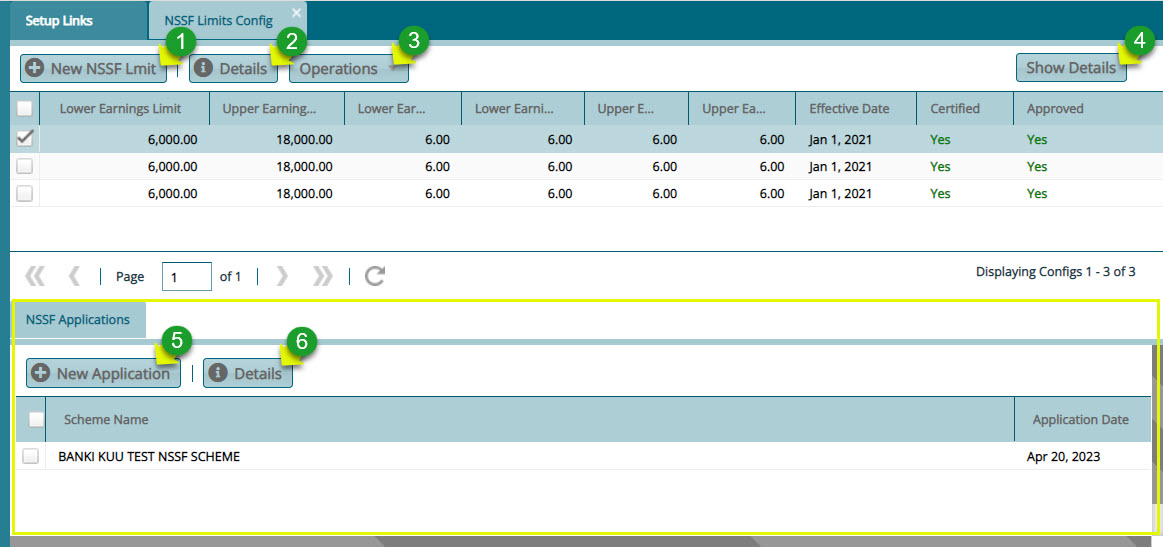

# NSSF Limits Configurations

Click the NSSF Limits Config link to open the NSSF Limits Confi window to view a grid table with limits configurations as shown below:

Action

Click label 1 button to configure a new NSSF limit.

Click label 2 button to view details of a selected Limit records from the list.

Click label 3 drop-down Menu to certify and approve a selected NSSF limit configuration.

Click label 4 button to load an NSSF Application window on the lower section of the window.

Click label 5 button to create open a window to select a scheme to apply the limit on.

Click label 6 button to view the details of a selected scheme from the applications window.

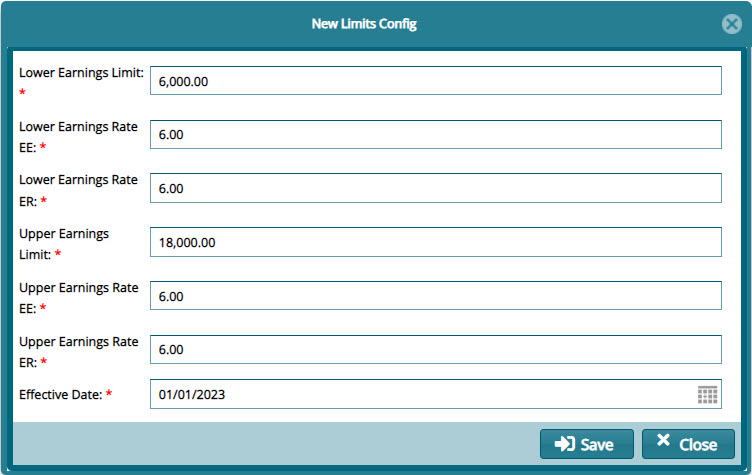

Clicking the New NSSF Limit button will open a dialog box. Fill in the details to create a new Limit shown below:

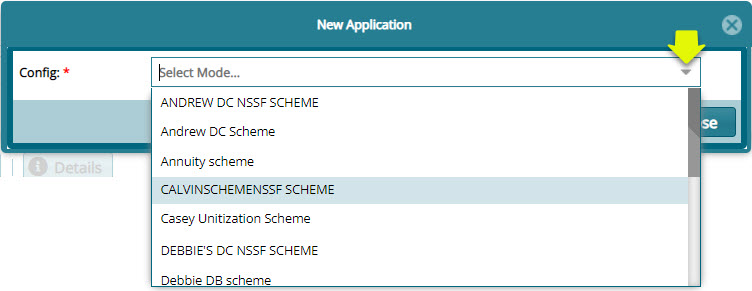

Clicking the New Application button will open a dialog box to select a scheme from the drop-down list and apply the NSSF limit configurations to as shown below:

Note: The scheme selected from the drop-down list will be configured in such a way that the members contributions in that scheme will be subjected to the selected NSSF limits.