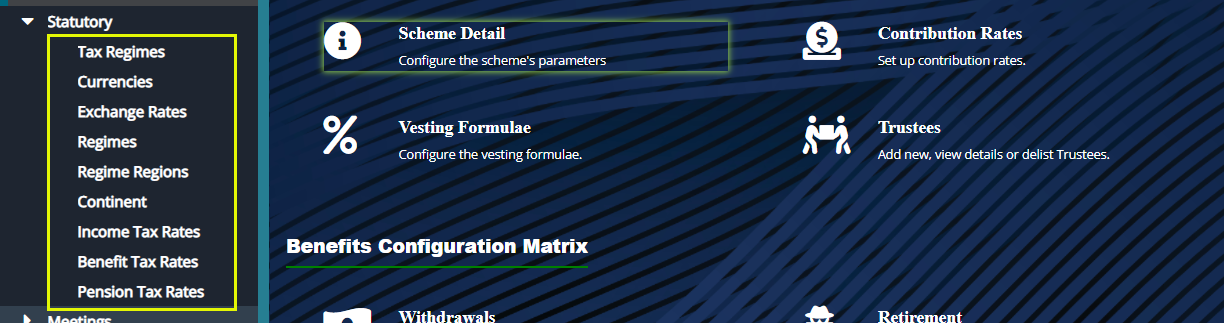

# Statutory settings

Statutory configurations are tax rates that affect the retirement benefits processes as defined by a regime’s commissioner of tax. The screenshot below shows a drop-down submenu with links through which different setups are done:

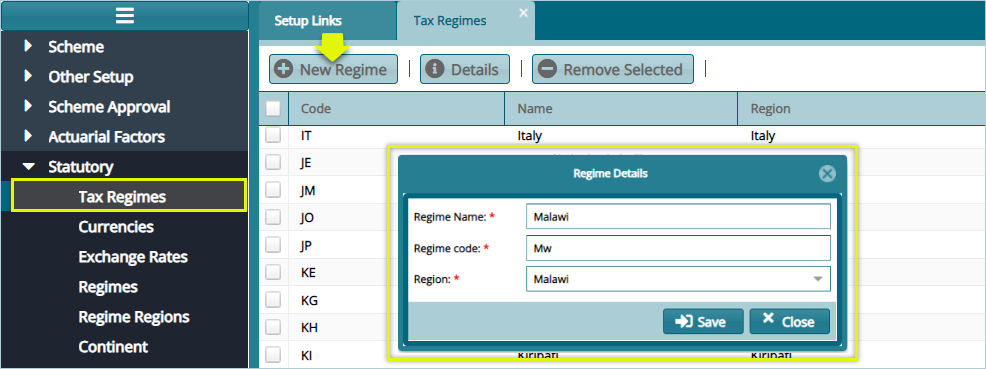

# Tax Regimes

Click the Tax Regimes link to open the Tax Regimes window, then click the New Regime button to add a new regime as shown below:

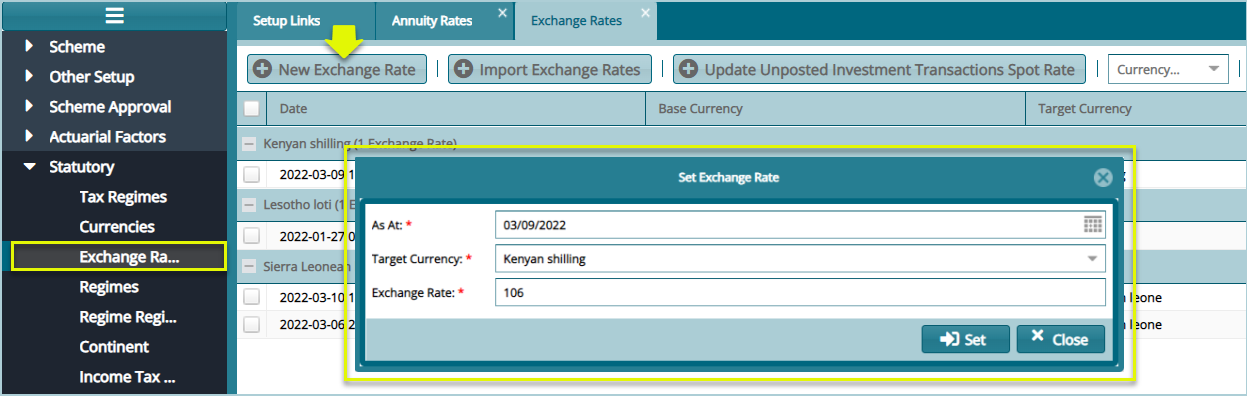

# Exchange Rates

Click the Exchange Rates link to open the Exchange Rates window, then click the New Exchange Rate button to add a new exchange rate configuration as shown below:

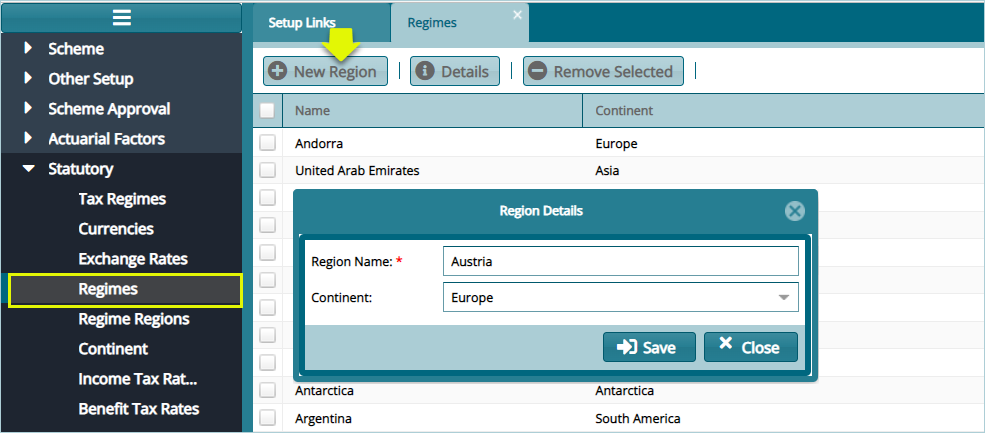

# Regimes

Click the Regimes link to open the Exchange Rates window, then click the New Regime button to create a new regime as shown below:

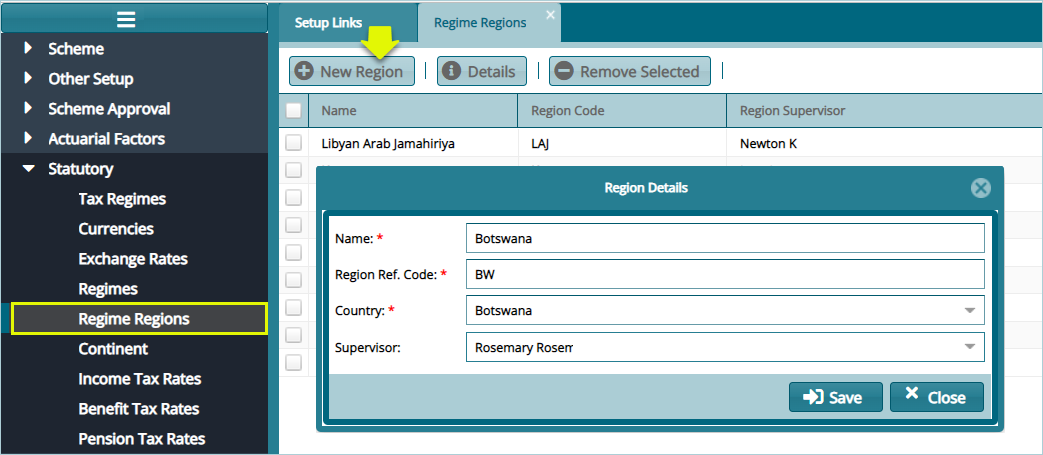

# Regimes Regions

Click the Regimes Regions link to open the Regime Regions window, then click the New Region button to create a new region as shown below:

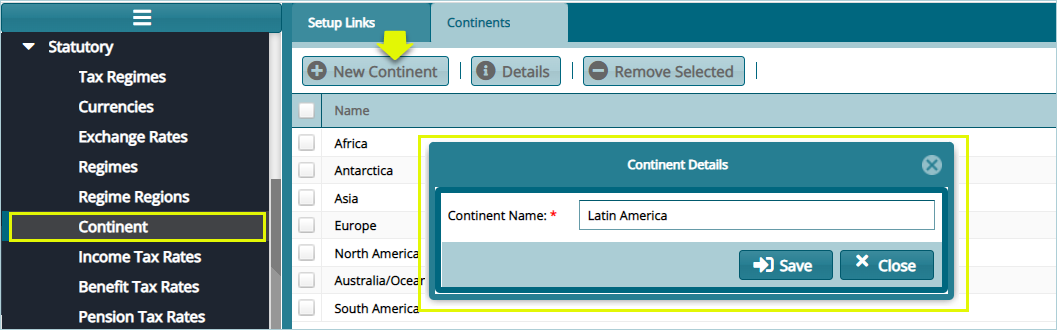

# Continent

Click the Continent link to open the Continents Window, then click the New Continent button to add a continent as shown below:

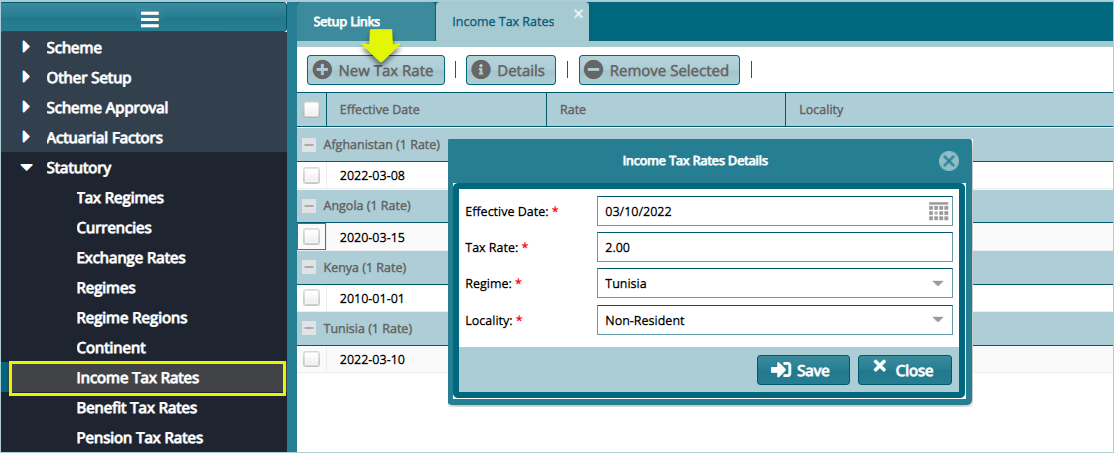

# Income Tax Rates

Click the Income Tax Rates link to open the Income Tax Rates window, then click the New Tax Rate button to define a new tax rate as shown below:

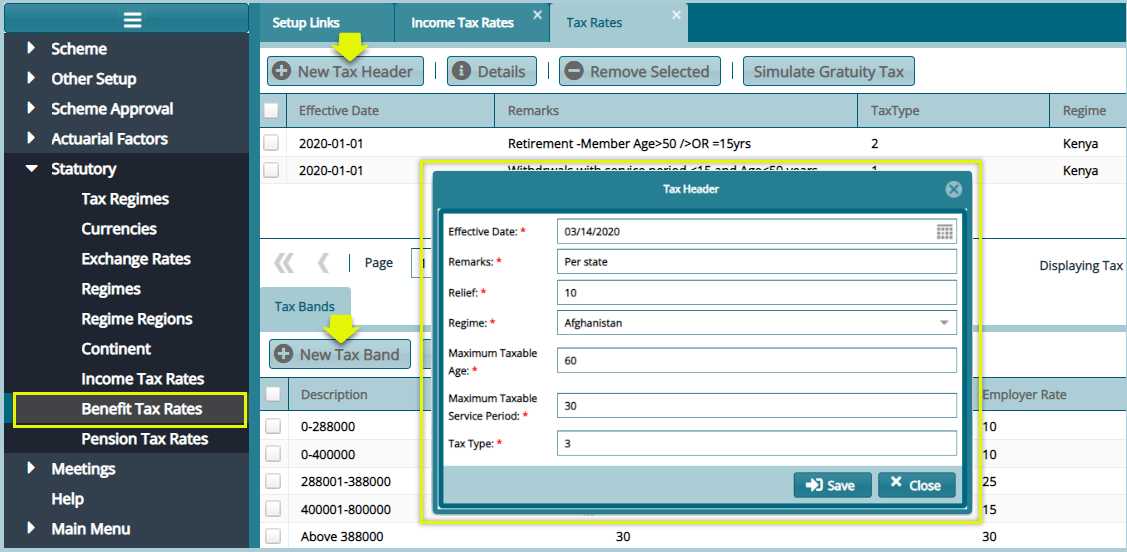

# Benefits Tax Rates

Click the Benefits Tax Rates link to open the Tax Rates window, then click the New Tax Heade button and the New Tax Band button to configure tax header and band respectively as shown in the following screenshot.

Tip

- The tax headers conditions and the tax headers are dictated by the commissioner of taxes in each regime.

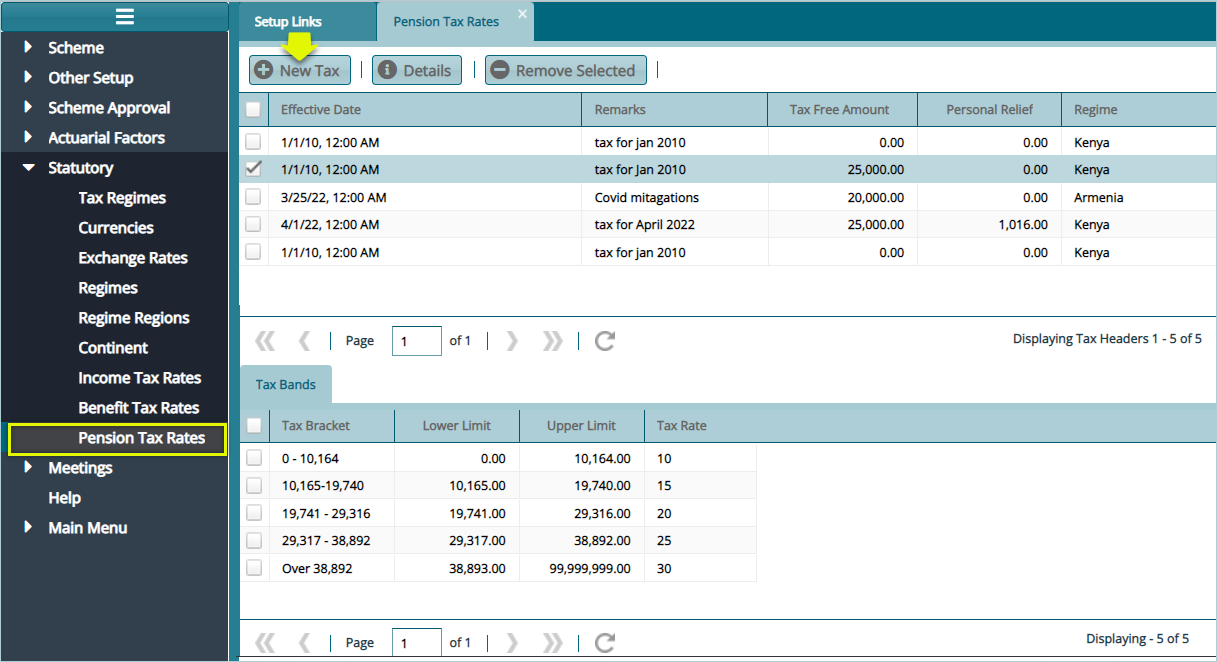

# Pension Tax Rates

Pension tax rates set of Configurations defines the pension tax free amount, personal relief amount. Selecting a new tax band will open a dialog box at the lower side of the window to aid in adding the pension tax bands as shown below: